In today’s edition of The Daily we feature the latest sports sponsorship by the cryptocurrency community. We also cover stories about new statistics on bitcoin usage in Israel, mining malware growth during 2018, and another bank blockchain patent.

UFC 232 to Have Official Cryptocurrency Partner

The Litecoin Foundation has announced that it will be the Official Cryptocurrency Partner of UFC 232: Jones vs. Gustafsson 2, which will take place this Saturday, Dec. 29. The Ultimate Fighting Championship event will feature a rematch between former UFC light heavyweight champion Jon Jones and UFC light heavyweight Alexander Gustafsson. The terms of the sponsorship cover the Litecoin logo being displayed on the Octagon’s canvas which the foundation hopes can bring new people to hear about it for the first time.

The Litecoin Foundation has announced that it will be the Official Cryptocurrency Partner of UFC 232: Jones vs. Gustafsson 2, which will take place this Saturday, Dec. 29. The Ultimate Fighting Championship event will feature a rematch between former UFC light heavyweight champion Jon Jones and UFC light heavyweight Alexander Gustafsson. The terms of the sponsorship cover the Litecoin logo being displayed on the Octagon’s canvas which the foundation hopes can bring new people to hear about it for the first time.

“There are several reasons why we think it makes sense for Litecoin to step into UFC’s world-famous Octagon now,” the group stated. “Over the last 25 years, UFC, the world’s premier mixed martial arts organization, has evolved from a tiny grassroots movement to a global phenomenon, largely based on the extremely passionate community it has cultivated along the way. We see many parallels to Litecoin in this way as our amazing community has been instrumental in our growth and providing unwavering passion and enthusiasm that continues to propel us forward.”

The cryptocurrency community has a strong record of supporting such sports events. Back in May for example, the mixed martial artist (MMA) Mei Yamaguchi was sponsored by Bitcoin.com as she faced the Atomweight World Champion Angela Lee. Dash has also previously provided sponsorship for fighters.

5% of Israelis Report Investing in Bitcoin

Bezeq, one of the largest telecom companies in Israel, released its 2018 State of the Internet Report on Wednesday. The report, based on data from Bezeq’s own system as well as a survey of 1,300 people aged 13 and above, revealed several interesting statistics about Israelis’ online habits during the year.

Bezeq, one of the largest telecom companies in Israel, released its 2018 State of the Internet Report on Wednesday. The report, based on data from Bezeq’s own system as well as a survey of 1,300 people aged 13 and above, revealed several interesting statistics about Israelis’ online habits during the year.

The figures show that cryptocurrency adoption still has a long way to go Israel, with only 5 percent of people in the country having invested in or used BTCand digital coins. Moreover, a total of 44 percent of Israelis say they either don’t know what Bitcoin is or just don’t understand the concept. In contrast, 42 percent of people have reported using the direct money transfer apps that the big banks in Israel having been pushing hard over the last year in an attempt to stay relevant in the digital age.

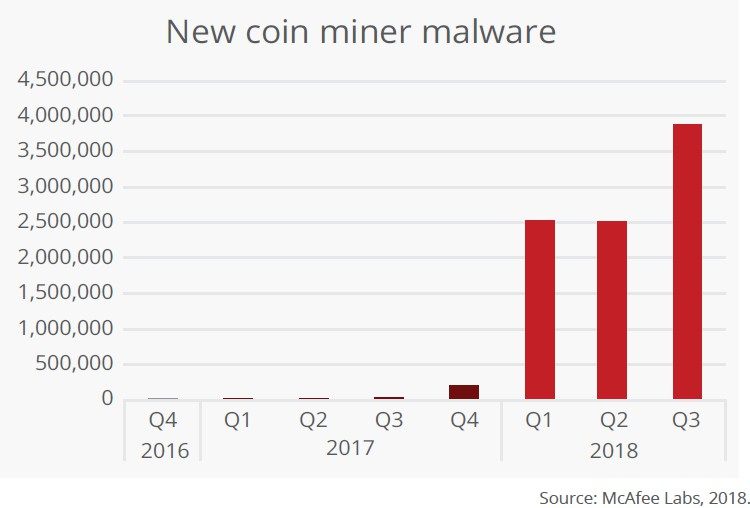

Crypto Mining Malware Boomed in 2018

McAfee, the cyber security company formerly led by the notorious crypto influencer of the same name, has released its latest Threat Report, highlighting notable cybercrime trends in Q3 of 2018. The report states that the “Cryptomining Boom Times Continue,” with covertly mining cryptocurrency via malware one of the big stories of 2018. Total instances of coin miner malware have grown more than 4,000 percent in the past year, despite the bear market. The report also shows that malware miners have been installed via exploits in everything for Macs to routers, media players and even very small IoT devices.

McAfee, the cyber security company formerly led by the notorious crypto influencer of the same name, has released its latest Threat Report, highlighting notable cybercrime trends in Q3 of 2018. The report states that the “Cryptomining Boom Times Continue,” with covertly mining cryptocurrency via malware one of the big stories of 2018. Total instances of coin miner malware have grown more than 4,000 percent in the past year, despite the bear market. The report also shows that malware miners have been installed via exploits in everything for Macs to routers, media players and even very small IoT devices.

“Cryptominers will take advantage of any reliable scenario,” the researchers noted. “We would not usually think of using routers or IoT devices such as IP cameras or video recorders as cryptominers because their CPUs are not as powerful as those in desktop and laptop computers. However, due to the lack of proper security controls, cybercriminals can benefit from volume over CPU speed. If they can control thousands of devices that mine for a long time, they can still make money.”

Bank of America’s Latest Blockchain Patent

Bank of America, who we reported on back in August as having filed a patent regarding the custody of cryptocurrencies, has applied for another blockchain-related patent. Documents from the U.S. Patent and Trademarks Office made public on December 25 cover the use of the technology for “banking systems controlled by data bearing records.”

The bank writes in the application that, among other things, blockchain technology may be used by automated teller machines to accelerate transaction speeds or facilitate other types of transactions in addition to ATM transactions such as cash withdrawals and deposits or gift registry transactions. Additionally, ATMs may use blockchain technology to track transactions, thereby enabling a larger amount of transaction volume while reducing physical cash transportation needs.

![[JBB.ONE신게임 특집 탐방 보도] 가득 불타는 턴제RPG <Crypto Sword & Magic> ---월간 활동 게이머가 70만 명을 넘은 게임이 블록체인에 왔다!](https://www.jbb.one/f/dynamic/img/3853014baf0b4cb2938f82aefdbc0cba.jpg!sss)

![[JBB.ONE 신게임 보도]< Cipher Cascade> 관련된 더 많은 내용을 가져 드리겠습니다!](https://www.jbb.one/f/dynamic/img/d65e572cec2446dcb2ace1a104abc991.jpg!sss)