For the past 10 years, the crypto market has grown from nothing to a height of roughly $850B.

While we currently hover around $230B, we are forced to ask ourselves what is the future for this industry?

At Lionschain Capital, we spend a lot of time trying to envision what the future of this technology holds.

Predicting the future is hard.

We envision potential scenarios and then figure out how the market is pricing the probability of those scenarios.

Things that changed my world

Growing up in the 90s was a magical time period for a tech nerd. The first computer I ever owned was a hand-me-down 286 IBM clone running DOS 5.0, which introduced me to my first programming language, QBasic.

Hugos House of Horrors was the first computer game I installed myself, (and completed through cheating by taking apart the game.) At 9 years old, I knew my life would be focused on computers.

My first modem was a 9600 baud, which I used to play Doom with my neighbor, and connect to a local bulletin board. From CompuServe to AOL to Comcast, our home was plugged into the internet before anyone else on the block. I remember explaining to everyone I knew how we would eventually spend more time on the World Wide Web, than in the real world.

Fast forward to 2007. I was a computer engineering student at the Jerusalem College of Technology when I first saw the iPhone.

I was a die-hard Palm Pilot evangelist until I touched the first iPhone.

The Palm Pilot showed what was possible on a mobile device. The iPhone showed how to do it right, and how to make people need it.

It was a life changing experience. About six months later, I got accepted for access to the beta iPhone SDK program, giving me early access to create applications for it. I dropped out of school that day to start my first company. I knew every startup in Israel would need an iPhone app, and the team I would create would build it for them.

Enter crypto

I first heard of Bitcoin in 2011 from some of my old college buddies. I still lived across the street from the university and wanted to learn everything about the technology for low scale mining. I was fascinated with the technical implementation but did not see the world changing potential. I was unconvinced at the time in Bitcoin’s ability to scale or create a real world economic impact. After a few months of tinkering with GPU mining I moved on to focus on my next start up.

In 2016 I was reintroduced to crypto not as a technology, but as an economic movement.

By mid-2017 I was convinced that crypto was going to be just as groundbreaking to humanity as the early internet, social networks, PDAs, and mobile phones.

For the past 3 years, I have watched as the foundations of the crypto space have been laid. We stand today firmly in the “Palm Pilot” phase of this groundbreaking technology / economic revolution.

Decentralized finance tools have shown us what can be built, but the ocean is still blue, waiting for the right entrepreneurs to come and transition the space from Palm Pilot to iPhone.

This is the most exciting time for any investor to be operating in an industry, right before it breaks out, but after most of the foundation has already been set in place

Where do we go from here?

We have laid out 9 different potential endgames for crypto.

Below, my partners and I break down how these scenarios may look in terms of market cap, user adoption, and likelihood over time.

Predicting the future involves a unique combination of humility and arrogance. Who am I to say what the likelihood is of a government shutdown or hyper Bitcoin-ization? I am just an analyst, doing my best to look at the past and present, and understand from them trends that shape the future.

The nice thing about putting things in writing is it allows your future self to come back and view what you wrote, to see what you still agree with and disagree with.

In addition, we open up these views to the crypto focused public to agree or disagree and engage in meaningful discussion on their views of the future of this space.

I hope to follow up on this post in 6–12 months with an updated assessment. Given the pace of change in this space, assuming I maintain a thirst for discovery, and a passion for research, the only thing I am confident is that my next post will be strikingly different than what I am about to share….

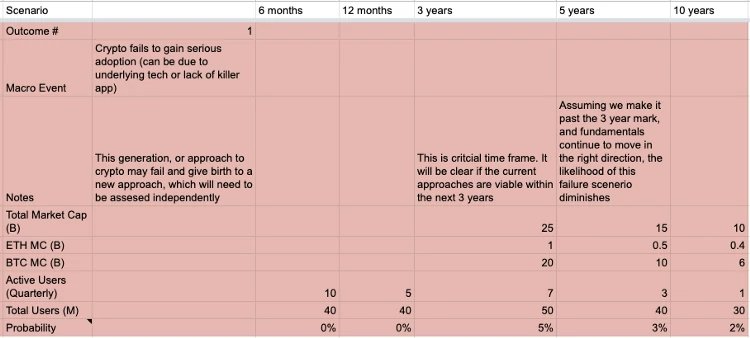

Scenario #1

Crypto fails to gain serious adoption (can be due to underlying tech or lack of killer app)

In this scenario, the crypto market attempts to break out with user-facing applications, with no success. Over time, many users abandon crypto platforms, and the market cap sinks. From a technology perspective, a generation (10 years) passes by, and crypto seems to have not advanced beyond the current state. No real-world problems have been solved, and the industry loses the shine it once had in its younger years.

We view this as a roughly 1/20 chance, with the 5 year mark being a critical juncture to determine whether something profound is happening here that speaks to the average western consumer.

Scenario #2

Crypto dies or is significantly delayed because it gains too much adoption and world governments shut it down

Bitcoin loses ala Bit Torrent

This is the second bear view on the space. Unlike the first, in this case, the crypto market grows rapidly, both in terms of active participants, and the value stored in the alternative financial system. Killer apps come to market, and adoption grows rapidly in the next 3 years.

World Governments begin to feel threatened and ban, outlaw, criminalize and sanction most things related to the crypto market, with a heavy focus on the leading money use case, BTC.

This is similar to how many countries approached Bit Torrent, the popular illegal file sharing platform. While adoption to Bit Torrent slowed, there are still an estimated 1M daily active users.

Against all odds, this approach somehow succeeds, stifling the growth and innovation of the space. Over time, alternative services pop up, and the crypto buzz seems to die down.

We view this as a 1/33 chance. It would require tremendous global coordination.

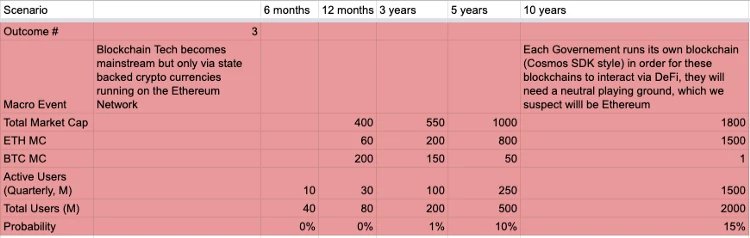

Scenario #3

Blockchain tech becomes mainstream but only via state-backed cryptocurrencies running on private networks connected via the Ethereum Network (or something similar)

This outcome is what I think of when I hear from other investors “Blockchain not Bitcoin.” In this scenario, the financial revolution dies, but the open source interoperable “world computer” vision presented by smart contracts is adopted and our current financial system ports over.

In this case, we pick two winners and a loser. Bitcoin is replaced as the settlement layer with Crypto-USD-Coin. Cosmos SDK is the go-to development tool for nation states to tokenize their native currency, and Ethereum is leveraged to create a level playing field for interoperable DeFi.

Because Ethereum provides value beyond a store of value, it may weather the storm of the collapse of Bitcoin, and re-position itself as an open utility for nation states to interact. Some other combination of protocols could replace Ethereum and Cosmos in this example, but this is our highest likelihood outcome for this path right now.

We give this outcome a 1/8 chance of occurring.

Scenario #4

Crypto remains a niche techie community

The diehards love it, but the rest are “meh”

In this scenario, crypto never really proves itself or gets off the ground. Unlike Scenario #1, where no one figures out what to do in this space, in this outcome, a decent sized following remains devoted to the space regardless of lack of break out success.

While some may feel they have found “the killer app” the majority of network participants move on, and the space stays flat at a modest level. Think of this like the “guys who build model trains”. It’s definitely an industry, just not one we want to be investing in.

We give this a 1/20 chance.

Scenario #5

Bitcoin becomes mainstream and becomes the financial settlement layer for the blockchain financial system

This scenario we would describe as “hyper Bitcoin-ization”

In this case, try as they may, no one figures out anything useful to do with blockchain technology other than sending Bitcoin.

Bitcoin, as a decentralized financial settlement layer proves to be useful on a global scale and fulfills its vision of “digital gold”.

We give this a 1/50 chance.

In this scenario, its possible digital assets on top of BTC get built out and the total market cap rises commensurately, but we did not include it in the exercise.

Scenario #6

Eth dominates in the space, becoming the leading smart contract provider, and storage of value, Bitcoin languishes

This outcome is most likely the goal of Vitalik, the creator of Ethereum.

The rise of a scalable Ethereum network leads to the “decentralize everything” and “tokenize everything” movement.

Finance moves over to the DeFi space, and day to day commerce is eaten by crypto daily spending.

Ethereum solidifies its issuance and monetary policy and makes BTC obsolete as a settlement layer, and ETH becomes the defacto store of value in cryptoland.

The interoperability of open source projects on the Ethereum network creates an impenetrable moat, bringing more and more developers, projects and entrepreneurs to the Ethereum ecosystem.

Mass adoption arrives because, everything you want to do, somehow becomes cryptorelated.

We give this a 1/10 chance.

Scenario #7

BTC and ETH become clear market leaders, each serving a differentiated market need as the total crypto market emerges to mainstream adoption

A world computer and Digital Gold

This is our Charlie and the golden ticket scenario.

Copywrite Dahl estate and Paramount Pictures, not used with permission

A secure Proof of Work, immutable, limited supply, settlement layer, combined with a scalable, highly interoperable, general asset issuance and computation layer working together to create a new Internet of Value.

We give this a 1/3 chance.. Currently we are still debating internally whether ETH or BTC captures more value in this scenario. Both can serve the SoV use case with nuanced differences leading to valuation disparity.

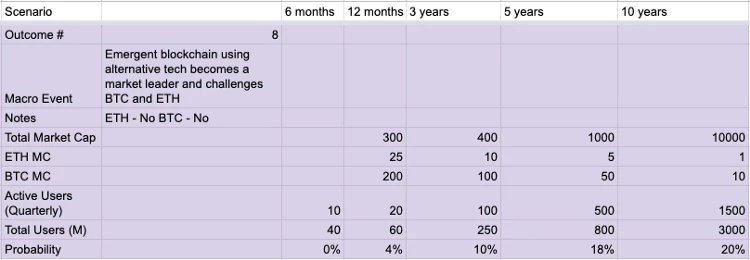

Scenario #8

Emergent blockchain using alternative tech becomes a market leader and challenges BTC and ETH

The current blockchains in the space become the “Friendster” and “MySpace” of the industry. A new player arrives and eats away market share until they are the clear winner, solving problems faster and better than Bitcoin or Ethereum (or maybe just Ethereum and BTC holds its position).

This could be a Cosmos, a Polkadot, Dfinity, Near Protocol, at this point it’s hard to say.

We give this a 1/5 chance.

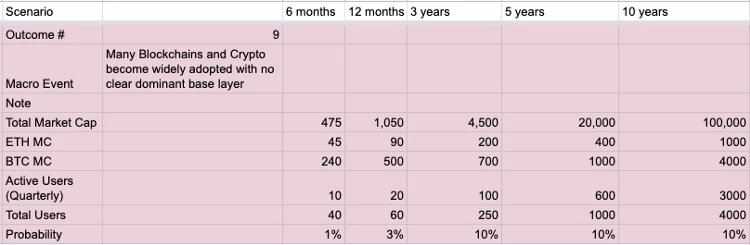

Scenario #9

Many platforms become widely adopted with no clear dominant base layer

In this case, the industry takes off, but due to varying intricacies in the space, no clear leader emerges.

It could be each geographical region gains a leader, or each nuanced use case has its king, but in the end, the crypto landscape becomes commoditized without a “winner takes all” scenario.

We give this a 1/10 chance.

Note — in our upside scenarios, the reason the Total Market Cap is so high is because we believe that most financial (and potentially non financial) assets will be tokenized and represented on public blockchains.

How to actualize all this information?

Now that we have walked through our views of the most likely outcomes, we can take these probabilities and time frames and perform an analysis on the potential upside of investing in this space.

Expected returns adjusted by probability

What we see here is that regardless of how this space matures, if the outcomes are close to our assessment, there will be many opportunities to see significant returns by investing in the crypto market today.

If you would like to view the raw Google spread sheet and make comments please use this link. We look forward to entering into a meaningful discussion around our current vision of the future and hope to help mature the space regarding valuation models and the potential return on investments.

Interested in Block Chain Game, Welcome to JBB.ONE

![[JBB.ONE신게임 특집 탐방 보도] 가득 불타는 턴제RPG <Crypto Sword & Magic> ---월간 활동 게이머가 70만 명을 넘은 게임이 블록체인에 왔다!](https://www.jbb.one/f/dynamic/img/3853014baf0b4cb2938f82aefdbc0cba.jpg!sss)

![[JBB.ONE 신게임 보도]< Cipher Cascade> 관련된 더 많은 내용을 가져 드리겠습니다!](https://www.jbb.one/f/dynamic/img/d65e572cec2446dcb2ace1a104abc991.jpg!sss)