Besides fat-fingered whales, the other species HODLers should learn to fear are large-scale Bitcoin miners whose electricity cost is zero. The reason? Their break-even point is low enough to depress the fair market value of the Bitcoin price, dashing the asset's seven-figure ambitions.

Just this week, Chinese police busted a gang of Bitcoin miners that stole electricity worth approximately $3 million for their crypto mining activities. Around 4,000 mining devices were being used in the illicit operation.

While the number of bitcoins that the operation had managed to produce is not clear, it is likely significant. Even more concerning is that this operation is likely just the tip of the iceberg; there could be many more illegal miners in China.

Illegal Bitcoin miners are turning insane profits

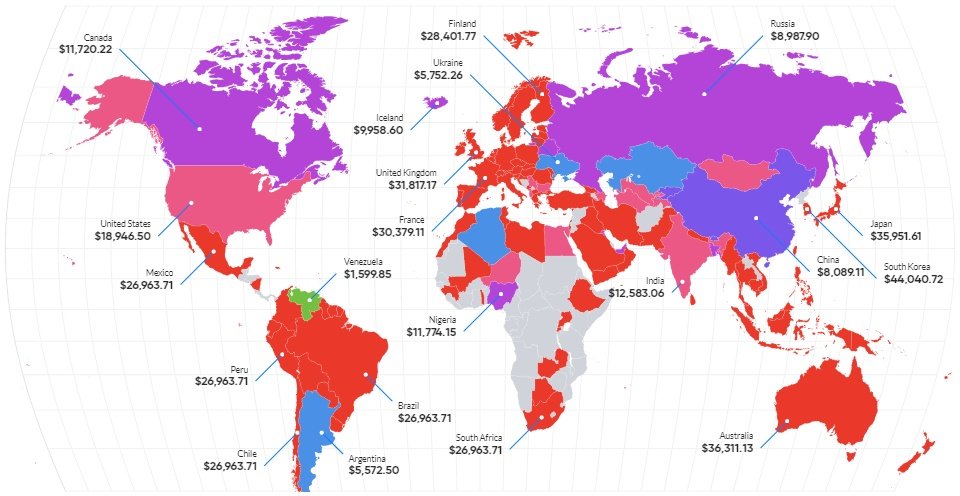

Currently, the cost of mining a single Bitcoin in China is about $8,000 when the electricity cost is approximately $0.045/kWh. But when that cost is zero - such as when stolen electricity is being used - then it means that the only expenses being incurred are the mining rigs, personnel, and rent.

With electricity cost exerting a dramatic impact on profitability, it means that those who are mining at zero energy cost are breaking even at much lower prices than $8,000 - which is already much lower than the global Bitcoin price.

This can only mean that at current prices, illegal miners in China are enjoying insane profit margins. And they'll remain profitable deep into a potential bear market.

The incentive to sell at the earliest opportunity is incredibly high, which can only lead to wild volatility and depressed prices. It is important to note that in periods of low volumes such as weekends, the number of BTC needed to cause a price collapse is greatly reduced.

Time for China to crack the whip on electricity thieves even harder

Additionally, when the breakeven cost is so low, the potential for prices to remain depressed is increased.

Last year when Bitcoin hit its yearly low, and when the breakeven price was $3,550, ordinary miners were doing business at a loss and were incentivized to avoid selling. But if they were using free electricity, they likely didn't feel the pinch of crypto winter.

It thus can only be hoped that Chinese authorities, despite not having embraced cryptocurrencies (at least not the "stateless" ones) will continue hunting and shutting down illegal Bitcoin miners.

They will do so out of their own interest, but it will be beneficial for the Bitcoin ecosystem all the same.

Interested in Block Chain Game, Welcome to JBB.ONE